Article 4

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Vivamus euismod nulla ac metus vestibulum, at sollicitudin risus porttitor. Vivamus viverra et risus id aliquam. Pellentesque…

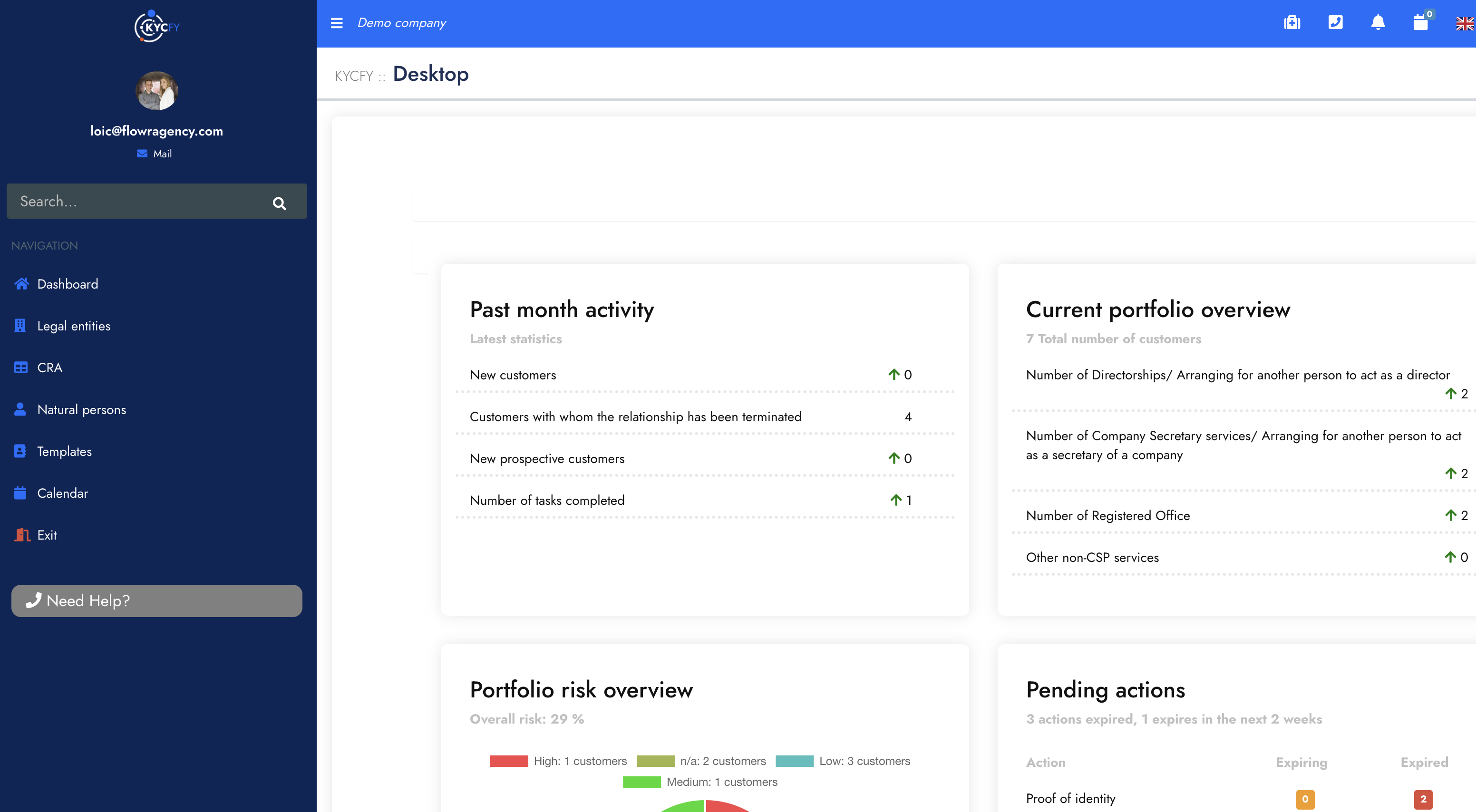

KYC software is a solution dedicated to the due diligence of your customers and for both the onboarding and the ongoing monitoring stages.

A dedicated team of compliance professionals with 20 years of experience in the banking, fintech and CSP sector. Established in 2013, our team has the mission to fight financial crime and to provide a top quality customer experience.

KYCFY answers to all the needs for corporate customer due diligence, customer rating and ongoing monitoring.

The aim is to facilitate the customer due diligence process and regulatory AML fulfillments.

Comprehensive downloadable data reports to ease the process of reports to the regulators

Customer risk assessment scalable to your business and needs.

The possibility to provide dedicated access to your intermediaries so that they can update the clients profiles, and request changes. Intermediaries have a specific access displaying the list of their clients and the types of service subscribed by each of them. The intermediary can request a new service or cancel an existing one directly through the platform.

Displaying the changes such as: directorship, beneficial ownership, shareholders, company secretary, and name of the entity

Automated onboarding form to be filled in by the prospect, and you retrieve the data directly in a dedicated section of the software.

All regulated and unregulated entities falling under the AML and CFT regime.

Due to its flexibility the system can be used by small firms such as notaries, real estate agents, fiduciaries, lawyers, auditors, and larger firms such banks, insurance.

We update you on the last features of our software

+35627026512

operations@kycfy.com

The Penthouse, 20 Lyons Range Court Bisazza Street Sliema SLM 1640 Malta